| MARKET ROUNDUP | |

| Dow | +75.91 to 16,569.28 |

| S&P 500 | +13.84 to 1,938.99 |

| Nasdaq | +31.25 to 4,383.89 |

| 10-YR Yield | -0.014 to 2.491% |

| Gold | -$5.20 to $1,289.60 |

| Crude Oil | +$0.61 to $98.49 |

Good ole’ “Uncle Warren.” The Cherry Coke-swilling, cheeseburger-eating founder of Berkshire Hathaway is a legend in the investing world.

Indeed, Warren Buffett’s down-home, folksy wisdom and long-term record of investment success have earned him legions of followers. The mere mention or rumor of an investment from Buffett is enough to send stock prices soaring, even if his “buy and hold” approach periodically goes out of favor.

So what is Buffett investing in now? Cash!

|

“It’s not just Buffett who’s husbanding cash rather than aggressively deploying it, either.” |

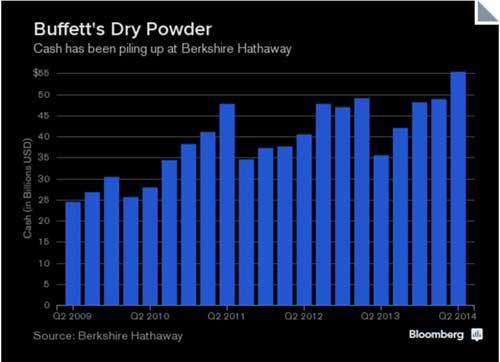

It’s true! Bloomberg News reported this morning that Berkshire’s cash hoard just topped the $55 billion mark in June.

How surprising is that?

First, Buffett has never had that much cash sitting idle at the end of a quarter in his more than four decades at the firm’s helm.

Second, cash on hand has surged more than 55 percent in the past year.

Third, the overall level is more than double the cushion Buffett says he likes to keep lying around in case of unexpected losses tied to Berkshire’s large insurance businesses.

|

| Warren Buffett’s Berkshire Hathaway has a cash holding of $55 billion. |

So what should we make of this trend? Well, if you’re an optimist, you could say Buffett is probably getting ready to launch another big round of mega-buyouts. He shelled out several billion dollars to buy up the Burlington Northern Santa Fe railroad in 2010 … several billion dollars more to buy a large stake in IBM back in 2011 … and several billion dollars more to help privatize HJ Heinz in 2013.

But if you’re more of a pessimist, you could raise an obvious question: “If Warren Buffett isn’t out there aggressively buying stocks, why the heck should I do so?” It’s not just Buffett who’s husbanding cash rather than aggressively deploying it, either. Private equity firms are sitting on their own $1.16 trillion cash hoard — the most ever, per Bloomberg.

I’m curious where you come down on this whole debate. Is this a sign that Uncle Warren is nervous, and therefore you should be too? Or is he just getting ready for his next batch of mega-deals, something that should have you licking your chops and scouting out potential Buffett targets?

What about you and your own personal portfolio? Are you finding a lot of solid investments? Or are you sitting on large amounts of cash because everything is too darn expensive or unattractive? Let me know at the Money and Markets comments section here.

| OUR READERS SPEAK |

After an ugly end to the week, many of you weighed in on the data that helped spark the selloff. Suffice it to say, you aren’t exactly “buying” the data the government is selling!

Reader Mitch said: “The economy figures are a sham. At the same time, U.S.A. is on life support, receiving 1/2 the tax revenue it is accustomed, too. Most employment is temporary hire, with no benefits and less pay and hours. No overtime.”

Reader Richard offered a similar view, saying: “The method of calculating unemployment statistics has been altered so much over the years that they are always questionable at best … Anyone paying attention knows that the economy is still weak and that the inflation rate is much higher than reported.”

Finally, Reader Hank commented on the quandary of how to run monetary policy in the current economic environment. He said: “The Fed cannot raise interest rates as the interest on the national debt would EXPLODE. As the economy sinks further into stagnation, tax revenues will fall. Those pushing austerity will ONLY push us closer to the EU and Japan. I believe we need a wage led revival of the economy.”

Me? I’m a skeptic by nature, and I don’t think any one report on inflation or unemployment is entirely accurate. But so many reports on so many facets of the economy are all pointing in the same direction — namely, that we’re in recovery, even if it’s not as vigorous as it could be.

So if you want to make money as an investor, you don’t want to be stuck in a bunch of recession plays. Instead, I believe you should stay focused on those select winning stocks in strong sectors experiencing their own “private” bull markets. But I’m always open to other opinions, which I encourage you to continue sharing here.

| OTHER DEVELOPMENTS OF THE DAY |

Another day, another attempt at a cease fire in the Israel-Hamas conflict. We’ll have to see if this one actually sticks, but there’s little room for optimism. In a bizarre turn of events, an Israeli civilian was run over and killed by a backhoe. The operator also rammed a bus, and was subsequently killed by police.

In other troubling Middle East news, ISIS rebels took over three more Iraqi towns in that country’s northern region. They may also be in control of the largest dam in Iraq, just another step in their stated goal of setting up an Islamic state across a stretch of territory in Iraq and Syria.

Portugal’s Banco Espirito Santo has collapsed, and just like we saw in the U.S. credit crisis, the bank’s sovereign government is coming to its rescue. The Bank of Portugal is bailing the firm out to the tune of $6.6 billion. It will split the firm into “good bank/bad bank” entities, which at least will result in shareholders and junior bondholders taking a bath. Depositors and senior creditors will be largely protected.

Is last week’s stock market stumble a flash in a pan? Or the sign of worse things to come? I’ve been sharing my insights here in Money and Markets, and this article from MarketWatch helps round out the debate.

Reminder: You can let me know what you think by putting your comments here.

Until next time,

Mike Larson

{ 35 comments }

IS THE RECOVERY FED-CONTRIVED OR REAL

I think investors would be better served by investing in Berkshire Hathaway rather than trying to second guess Warren Buffet. He is not going to go public until he has made his trade, so you are not likely to profit on short term trends. Just do like he does and buy quality for the long haul.

The fact a wide range of investors hold lots of cash today is a reflection of a lack of confidence in the market, the economy, The FED, and the Federal government. Market confidence still has not returned to the levels it was previously at in 2007 and it may not for some time to come. Historically low daily volumes on the NYSE attest to this fact.

People are holding cash for a variety of reasons of their own. Some investors are waiting for stock prices to come down to where they fit their screens, such as some value funds. Alternative investments such as precious metals, artwork, and numismatic coins also siphon-off funds that might have been invested in paper assets ten years ago.

I’m more in cash then I’ve ever been. I’ve been waiting for the correction since January and I am still waiting. I was going to by a stock today but when Warren and so many others are in cash, I back out.

One sure way to estimate the real unemployment rate, especially among those with graduate degrees, is just to look at how high LinkedIn is. The more it goes up, the higher the unemployment is among this group of people, regardless of the discipline.

I think Warren Buffet doesn’t know what to do either. No one can predict the future.

what drives Buffet’s investment decisions can be determined here , an expansion policy that promotes supply expansion is NOT what we have , but instead we see a Internal capital infusion to shore up the primary investment vehicles as we sit in limbo waiting for their decisions as to what to do about the future of Growth , http://www.lifenews.com/2014/03/18/warren-buffet-foundation-hires-abortion-activist-to-spend-millions-on-population-control/

Methinks he is having a hard time finding enough value to deploy cash in the amount he needs to in order to move the needle.

Has anyone ever done a correlation of Berkshire cash v. the S&P 500?

You got to play both sides of the fence, and at some point jump on one side. Me, I am 50% in cash weighting for the crash to double down on ETF`S and stocks. In the mean time picking off anything I can get a 4-6% on.

Hank is correct: at higher FED interest rates government debt could not be serviced. Derivative addicted bankers will prosper and fuel inflation, while the FED’s QE steals from savers to allow Uncle Sam to pay social security, welfares, bureaucracy, medicine, science… That becomes real circulating money to also fuel inflation, skew the economy toward make-believe jobs, and widen undeserved income gaps. Meanwhile the bulk of the economy will likely be sinking until the US worker is as poor as low wage Asians, and thus competitive again. So, invest in multinationals and gold, not in domestic America.

Buffet is a insider. He knows where value is. He is smart rich and mysterious.

By all measures the stock market is overvalued. Shiller CAPE, market cap to GDP. Corporate profits are at record highs, margin debt is again at record highs, and it’s been 5 years and we’ve had neither a bear market nor a recession. I would hold no less than 20% cash.

Per Larry’s recommendations the last couple of weeks I’ve been selling stock positions, hanging onto the precious metals and mining positions and just today purchased a stake in the 2x inverse S & P ETF SDS.

After all is said and done…. I doubt gold and silver will do very well this year.

I was sitting on about 23% cash going into last week. I placed several limit buy orders which hit today. Y, WRB, AXS, MCD and GLW so now I’m down to 8% cash.

It’s no surprise that Warren Buffett is holding cash. He’s ALWAYS holds cash – money that comes in as profits from the various companies he owns entirely is where it comes from. So it’s not at all unusual for Buffett to have a huge pile of cash on hand, and its nothing to worry about per se. He does it all the time while looking around for the next good buy. And you probably should too until you’re ready to make a wise investment selection. Why would you do otherwise?

When Buffett buys a company “lock stock and barrel” he does so specifically to get the cash flow the company generates. In effect he takes a 100% dividend from them rather than whatever small percent of profits CEO decides to share with stockholders. And unlike at other stock companies Warren Buffet does not allow his wholly owned companies to make significant investment decisions on their own. This stops them from doing silly things with stockholder capital that other companies do – like stock purchase stock in other companies (try their hand at “picken ’em”), embark on loser projects, or waste money on ill advised stock buy backs that are rarely timed right and usual don’t do anything at all to the stock price. (Can you say “torching dollars”) This is why Warren Buffett’s “cash hoard” grows so quickly.

Of course this doesn’t mean a Buffet (or Berkshire Hathaway) owned company doesn’t have access to cash to grow their businesses. Quite the opposite – if his company managers have good ideas for growth Warren is always glad to hear about them. And if he’s convinced they’re good (and meet his 15% ROE minimum) he’s more than happy to fund them – either with cash (which he has a lot of) or with debt, or a combination of both. Since Berkshires Hathaway’s borrowing costs are low, even when he tacks on a 1% “markup” to his subsidiaries they have cheaper debt than any of them could have done on their own anyway. So in the end they actually have better access to funding than ever before.

But you don’t see big drops in his total cash “hoard” very often because he has so much more money coming in than he spends each month. It’s not that he’s not making smaller investments all the time. He does, but they’re often not big enough to make headlines and they don’t drop the total cash balance he has on hand that much unless he has a real monster purchase (like the 44 B. buyout of the Burlington Northern RR) using up a lot of cash at once.

And just because he holds cash does NOT mean he’s afraid to hold stock. Buffett has a lot of equity – including both in stock and in his own wholly owned companies. And you shouldn’t be afraid of holding stock either. If you have stock that you “bought right” or bought a long time back and those companies are still excellent, great – hold on. If you are contemplating where to put new money on hand to work – do the same things Warren does. Take the time to “do your homework” and find outstanding companies that are either “on sale” (selling for less than their intrinsic worth) or at the very least modestly priced but have a great future. There is no rush, and you didn’t miss out on anything if the market went up a few ticks yesterday and you still have cash in hand. Cash is good – so relax.

The US economy has been recovering (slowly but steadily), the P/E ratio of the S&P 500 is a very modest 17 at the time of writing (it’s long term average is between 18-20), and global capital is finding its way into the US and the US markets. (After all – wouldn’t you get your money out of just about anywhere and to the safety of the US dollar and the robust us stock market at this time?) Just have faith that there are good investments out there, and if you put in the time and effort needed to find them – at the right price (of course) you’ll be rewarded for your efforts.

And in case you feel like you can’t compete with the likes of Warren Buffet – with all the money he has and all the special deals he works out – keep in mind what Warren says himself about your prospects for success in the stock markets. “You can’t play ‘my game’; but you have a better game”. By which he means you can’t do some of his crazy deals – but you aren’t held back by what slows Buffet down – the fact that the deal has to be HUGE to have any impact at all at Berkshire Hathaway. You can do what he can’t – buy stock in smaller and faster growing companies, and in that way you’ll do fine, and possibly even better than Warren himself can do from here on out. Remember what his challenge is – Warren Buffett is trying to push an ‘aircraft carrier’ – you are not. When it comes to investing in the stock markets – small is beautiful.

Happy investing.

John

Its extremely hard to know how long the manipulation can last. We have to few in the work force to say unemployment is even close to where the say it is. To many part time employees and Obama Care hasn’t even started to do the damage it will do if it stands. After mid term election look for all hell to break loose. Anyone shopping knows inflation is much more than claimed. Government statistics are useless anymore! If interest did jump up three or four percent then the government would really have to print some cash. Timing is everything but something big will come in the next year I feel. Middle east is biggest mess ever in my lifetime! What a disaster in the way the president treats our only ally in the middle east! Look for more war involvement soon!

Waiting for the correction before I invest in a S&P index. Sold a China fund and foreign currency fund. The world is falling apart because Obama would rather be a golf playing figurehead instead of being a real President. China simply isn’t ready to take over as a world power yet.

I’m 53% cash and a little worried if that’s still too much invested; I’ll watch this week’s round of earnings closely.

I’m 80 % cash due to overblown market with no correction for years. I will buy slowly after a correction. I’m about 18 % physical Gold and Silver, purchased over 25 years so I’m fine on that and I have no debt and the home is paid-off. Guess I’m in good shape as I’m 66 and still working, but only part-time

I am sitting on Cash – based on calendar months. I think Sept/Oct could provide a opportunity to get in market, I am expecting some correction. I just liquidated some stocks and so no point in getting market for one month of Aug.

Not sure if this makes sense to any one else.

Thanks

I don’t have that much to begin with. The small amount I have is to help grandsons with college. Half is in cash and the other in small positions in defense, industrial, health and computing. The way the world is going, we need to have a strong smart military with high tech equipment to support it. Most of all we’ll need folks with good thinking and doing skills.

on the side lines nothing looks good

I guess I’m a doomsayer as everyone tells me but I see no good consequences to the incredibly moronic, self-serving, if not intentionally masochistic economic, immigration, & trade moves by our elected officials & the FED !

Remember the stagflation of the 70’s ? Multiply that by 3 or 4, at least. And there is NO solution that will not be EXTREMELY painful, very long, ENORMOUSLY DEADLY & chaotic,

Plainly, rhetorically, AMERICA, as we have known it, is finished.

The rest of the world doesn’t like America. We’ve been on top too long and as all in that position, we have forced our will much to the detriment of many, many, many other countries/peoples !

They are/will abandon the $ eventually as the world reserve currency.

This in itself will ignite or spur runaway inflation.

There will quite likely be another stock market collapse ! We are in a Presidential, FED, Treasury induced stock market bubble ! The pin that will pop it could be any one or more. of a handful of factors.

The ONLY reason all this hasn’t occurred already is that the rest of the world is still dependent on America as the world economic engine. The difference now is we are still the world’s biggest buyer. The trouble now is we are not regressing as the world’s biggest producer. Hello CHINA 111

Our FED keeps purchasing most of our own debt !! This is how we pay our creditors !

Does anyone see a catastrophe in the making ?!

The problem is that the rest of the world can’t figure out a way to abandon the $ without messing up their own/the world’s economies !!!

THEY WILL EVENTUALLY, BE FORCED BY AN BLACK SWAN EVENT, OR WILL SAY “DAMN THE TORPEDOES” AND CHALLENGE THE CONSEQUENCES !!!!!!!!

Mike you miss the whole point. Warren is gathering money up so he can give it to Obama!

The economy is improving but the problem of jobs is a worldwide one. As labor has lost bargaining power wages and security has been lost Henry Ford told us in 1930 this was a road to disaster because without wages there is no one to buy corporate products.

If he has that much money I wonder if he would consider giving me a sub.(loan)

I am sitting on much more cash than usual. I do not believe that enough people are looking at the turmoil all over the world and how it will effect the U S. Add in a feckless President and I believe that real trouble is headed our way. If I am right, some real investment opportunities will be available if you have the cash.

I’m 70% cash right now expecting a correction. At 64 1/2 years old capital preservation is starting to effect my decision making

Mike,

I like to compare the market hype, by the brokers, to the Dutch tulip bulb hype. When it ends, watch out!!

Travis

Regarding Buffet sitting on cash…

I’m doing the same thing. I have about 90% of my portfolio in cash right now. The portion that is invested is either in gold-related funds or inverse funds. I have very little confidence in the current environment.

As a long-term paid subscriber of various Weiss publications, I’m (in part) waiting for Larry’s “back the truck up” call on Gold. I’m also waiting for some correction in the broad stock markets before getting more fully invested.

Caine

Misnomer; Warren Buffet has $55 billion in cash.

Truth: Warren Buffet has 0 cash and $55 billion in bank accounts.

The difference is significant in the event of a run on the banks.

Why must we keep hearing about the Oracle of Omaha? Better that he should be called the Butcher of Omaha. He has given over $1 Billion to Planned Parenthood through the years, so that probably makes him the greatest mass murderer of all time.

Warren Buffet,,, h’mm, how about insider trading making him look so smart??? He buys a railroad when the Keystone oil pipeline is gaining support and the railroad not looking so good,,then, his personal friend in the White House,, screws over the pipeline which “forces” the oil to be carried by the railroad and he makes a windfall! Nothing but insider-trading at the highest level. If he did this once, he probably has a track record.

Both my wife and my accounts 100% in….most went down today…..ours went up….:)

Hi Mike

I started buying gold stocks in smaller parcels June last year. As the price went down I $cost averaged with larger quantities on my way to the bottom in December. Have been trading on the ups and downs with about 10% of my holdings and now have a lower average buy in price. I didn’t buy at the lowest price, but am prepared to take the longer term risk. I’d like to thank you and Larry for your entertaining and informative views.

‘Little Mr. Buffet

Sat on his tuffet

Of piles of hoarded cash

He’s waiting to buy silver and gold

As much as any bank can hold

Before the U.S. dollar falls on it’s a$$!