|

The economy added 222,000 new jobs in June, per the most-recent jobs report. That was the biggest increase since February.

On top of that, the unemployment rate fell to 4.4%, from 4.7% at the beginning at 2017.

The stock market was pretty impressed by the top-line numbers. But there’s a little-noticed trend taking place in the U.S. labor force.

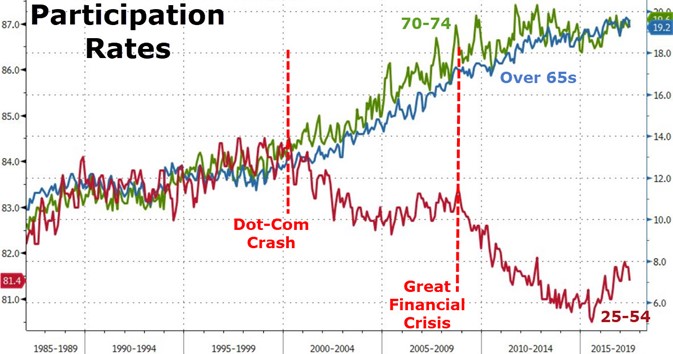

If you dig just a little bit deeper, you’ll see the dramatic increase in the number of senior citizens (age 65-plus) who are still working.

How dramatic? Well, the percentage of seniors who are working is at a 55-year high!Â

Get this:

- 32% of Americans age 65 to 69 are still working.

- 19% of 70- to 74-year-olds are working, up from 11% in 1994.

I’ll turn 61 in September, so I’m just a few years shy of the traditional retirement age. However, I plan on working for many, many more years. I really enjoy my work, and my vegetable-farm upbringing just won’t let me not work.

Heck, our founder Martin Weiss is on the tail end of his 60s. And he puts me to shame with the vast number of hours he works!

Hey, we’re not complaining. Martin and I are lucky because we truly love what we do. And it’s great to see that we have lots of gray-haired company, as more and more Americans feel just like we do about staying productive.

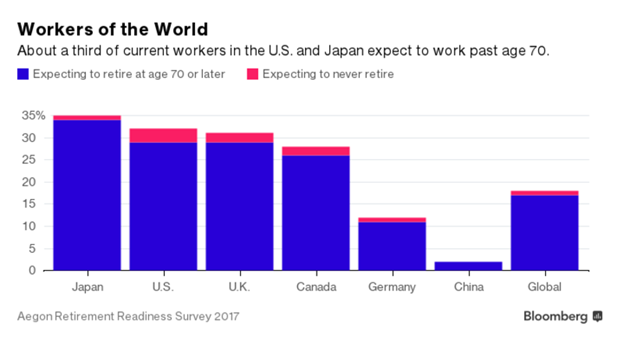

A third of Americans expect to keep working past the traditional retirement benchmark of 65.

- 22% plan to retire between 66 and 70 years of age.

- 7% are going to wait until their early 70s.

- 3% won’t quit until age 75, and 8% plan on working until they die.

Nearly 20% of Americans 65 and older were in the labor force last year. That’s up from 16% in 2007 and 10.8% in 1985, according to the Labor Department.

|

|

| Image credit: ZeroHedge.com |

The Bureau of Labor Statistics (BLS) expects that number to keep growing. It estimates that 36% of 65- to 69-year-olds will be working by 2024.

And if you include part-time work, that number jumps to a whopping 79%, according to the Employee Benefit Research Institute.

Why are Americans working so deep into their golden years? A number of factors come into play.

|

People are living longer than previous generations. Some, like me, truly enjoy their jobs. And others just want to stay active.

However, a big percentage of working seniors say they have to work:

- 48% cite medical issues.

- 44% want to pay off debt.

- 39% blame the high cost of their mortgage.

- 37% help family members.

- One-third cited a bout of unemployment.

The U.S, by the way, isn’t the only place people are planning to work longer. Around the globe, workers of all ages are moving their retirement goals later and later in life.

No question: People are living longer and healthcare costs are rising, so retirement is more-expensive than ever. But a glance at the above chart shows that one big driver of senior citizens working is the decimation that bear markets wreak on Americans’ savings.

Worse yet, most haven’t saved enough to finance retirement.

Some 30% of Americans have no retirement savings. And of the 68% who do, 30% have less than $100,000 while 34% have between $100,000 and $500,000.

Is there an investment opportunity hidden in this trend for Americans to keep working well into their retirement years?

You bet!

I’m talking about the growing demand for income-producing assets, such as real estate, dividend-paying stocks, and bonds.

In fact, the last two stocks that I recommended in my Disruptors & Dominators newsletter are exactly those type of stocks. They offer fat dividends that should be core holdings for every aging baby boomer who would enjoy spending their golden years on the golf course instead of behind a desk.

Get this: A whopping 10,000 Americans turn 65 years old EVERY day. So the opportunity … and the potential payoff … is huge.

Best wishes,

Tony Sagami

{ 7 comments }

Where can I find out your verified, across – the – board, track record, or your recent picks that I can track for 6 months to see if you are any good?

Tony Hi, We retired at 62 (Industrial Chemist) & 60 ( private practice OBGYN) . We have not missed work. We enjoy scuba diving, snorkeling,swimming and touring. We spend three months in Florida and three months in Hawaii. We are adding more travel to Roatan, Cozumel, Bonaire, Malta and other dive & sacred sites. We live on the Eastern Shore of Maryland. Retired with 2 million +, nice utility pension, paid off house and goal of 15% bracket until more $ are required for adventure. The work forever model was not for us . We have worked like crazy since 10 years old family farm and family plumbing. Keep Smiling Letro

Need to learn how to profit in retirement.

LIVING LONGER OR DYING SOONER ?

Medical reality for many of those over 65 is the growing limitations of health care related issues to their lifestyle or work style. For example, anyone who grew-up and participated in WWII (The “Greatest Generation”) probably smoked during that era. K-Rations came with free cigarettes. Unfortunately, most people who smoke will eventually develop COPD (Respiratory Disease). So, shortness of breath is a common symptom of this ailment and its progressive, getting worse with age, not better. No cure either.

Smoking is also a risk factor for those with cardiovascular issues ( Heart Disease). Plenty of people today have heart disease, often genetic. By your seventies, you will know it. Some will have fatal or near fatal heart attacks by then if not before. Lifestyle issues and especially diet contribute to the onset of systemic Cardiovascular disease. So, you won’t be working after a major heart attack if you are in your late seventies. Instead, you would probably be disabled or have limited mobility.

Initial trends suggest Baby Boomer as a cohort may not live as long as their parents ( The Greatest Generation) due to lifestyle and health related issues ( Alcohol and Drug Abuse). Many may die relatively young, perhaps in their late seventies instead of their late eighties. This will solve the medical care cost problem: patient deaths or shorter lifespans. Its nature’s way of reducing overpopulated habitats back to the carrying capacity ( available resources).

The way Medicare looks at it, delaying or denying care is very cost effective. Welcome to the coming World of Health Care Rationing. Demographics, low economic growth, reduced productivity, and escalating medical costs, plus much tighter Federal budgets in the future portend less Medical Care for the Elderly, not more. You therefore must take care of yourself. Fewer workers will have stable careers for 30 years, good pensions and health care benefits. They will have to fend for themselves all their lives and often as not, Take What they Can Get. It will be less than the previous generation in all probability.

I plan on working until i die if i am able. I am 85 now.

RAW DEAL FOR SOME RETIREES

Visited In-and-Out Burger for lunch. Talked with a 79 year old CPA who is still preparing business and individual tax returns. It did not seem like he ever plans to completely retire as long as he is healthy enough to sit at a desk in his office. My guess is all it takes is one divorce to ruin your individual retirement plans. At a minimum, it would set you back a number of years or reduce your lifestyle.

For example, in Oregon, a retired Oregon State Policeman (20 years-reduced pension) had a divorce. In Oregon, PERS pension benefits are property that can be attached by a former spouse. So, no “retirement”. Instead, he had to go back to work the night shift doing vehicle patrol for a Private Contract Security Firm for $12.00/hour. That is life ??

So, all it takes is one divorce to ruin your retirement plans. A high divorce rate suggest many worker’s plans have already been changed whether they know it or not. Work for 30 years and then give half to a former spouse. The government takes their cut (income taxes), as well. You get what is left. A raw deal indeed.

We are early 70s, and have a retirement business that lets us travel a lot. We have a reverse mortgage, moderate savings, and some classic cars to restore and sell later. Classic retirement ideas have always seemed boring to us, so will stay active doers and builders till the last day. Crayq