|

Iraq is on the verge of falling; and the greatest mistake anyone could make is to underestimate the consequences.

IF it were falling to freedom fighters, right-wing generals or even leftist guerillas, it wouldn’t be so shocking. We’ve been there, seen that — we’d know how to deal with it somehow. But …

That’s not what we have in Iraq today. They are terrorists. They are — or were — Al-Qaeda. In fact, they’re so radically extreme, so vicious, so uncontrollable, even Al-Qaeda itself has cut off all ties.

IF this group — the Islamic State in Iraq and Syria (ISIS) — were just a typical terrorist organization, operating in small splinter cells, planning random attacks on isolated targets, we’d know how to deal with that as well. But …

That’s not who they are. They’re an army. They’re sweeping Iraq in a blistering blitzkrieg. They’re snowballing in size, gathering thousands of Iraqi army defectors and militants into their fold. They’re taking over government army bases, arms depots, refineries, power stations, big cities, even entire provinces.

|

| Abu Bakr al-Baghdadi. As  commander of the Islamic State in Iraq and Syria, he is now widely viewed as the “rising star” of global jihad. |

Or, IF Iraq were a small, inconsequential country, maybe we could just write it off. But …

That couldn’t be further from the facts. Iraq is the most populous Arab nation in the Persian Gulf region, the second biggest in area, and also the second largest in terms of oil reserves.

IF Iraq were disconnected from U.S. history and destiny, maybe our government could find a way to ignore it. But, again …

Nothing could be further from the truth. The U.S. has spent close to $800 billion in direct wartime efforts in the region, will have spent nearly $1 trillion in war-related veterans benefits, plus trillions more in interest and other costs. The grand total, according to a recent Brown University study? Close to $6 trillion, or sixty times more than Washington’s cost estimate announced just before the Iraq war began.

Or, if we could just put the past behind us and move on, that might be an escape of some kind. But …

Sorry — not possible. If Iraq falls, it’s bound to set off a chain of events that chops up our foreign policy, ricochets through time and impacts nearly everything we do, or plan to do.

All this raises urgent questions, many of which you are already asking me:

How could the United States save or win back Iraq?

Only with extremely undesirable tactics and consequences!

The U.S. government and military would have to do things that are so unthinkable, only a certifiably insane White House would even consider them …

It would have to accept the just-announced, desperate request from Iraq Prime Minister Maliki — to launch U.S. air strikes against his own people, just as Syrian President Assad has done against his.

It would have to coordinate closely with the hated Assad regime — for the simple reason that he’s currently fighting against precisely the same enemy.

It would even have to enlist the allegiance of Shiite Iran, the only big power in the region that’s actually very close to the Shiite regime in Iraq.

And in the process, it would have to force Iran’s sworn Sunni enemy, Saudi Arabia, to cut off all ties with Washington, or worse.

None of this is likely to go forward. Even baby steps in these directions would be blocked at the pass or lead to immediate disaster.

What happens if the U.S. lets Iraq fall?

I don’t even want to think about the answers. No one does. But we must. So let’s at least consider the obvious:

First, a deafening rally cry of “great historic victory” by all anti-American forces in the region, injecting new vigor into their quest to take Lebanon … topple regimes on the Arabian Peninsula … return to power in Afghanistan … conquer most of North Africa … and, worst of all, rule nuclear-powered Pakistan.

Second, the biggest U.S. foreign policy disaster since Vietnam, dealing a severe blow to U.S. credibility, hegemony, and influence — not just in the Middle East, but also in Eastern Europe and the Pacific … not only with potential adversaries, but also among close allies in Western Europe and Latin America.

|

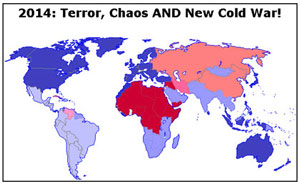

| Click for larger version |

| Blue areas — Western-style democracies. Orange — former cold-war adversaries and their allies. Red: terror and failed states. Gray — mostly neutral, for now. |

Third, a power shift in the new cold war. As my maps demonstrated here last month, the old cold-war divide between East and West has again burst onto the scene, with new fault lines appearing very near where the old ones were before.

And now, if the U.S. loses Iraq, it automatically emboldens China and Russia.

Fourth, economic consequences — a new bull market in gold, rising oil prices and more.

Here, though, there’s also room for optimism: Thankfully, the U.S. is far less dependent on Iraqi oil, OPEC oil — or any imported oil for that matter — than it was in the past. Already, select oil companies have benefited tremendously. And already, smart investors are making money hand over fist.

More on this very positive trend– and how you can profit from it — coming soon. Stay tuned!

Good luck and God bless!

Martin

|

EDITOR’S PICKS

ECB Action Alone Won’t Defeat Deflation by Bill Hall We are moving in the right direction, but we aren’t out of the woods yet. And as each day goes by, I become more concerned. Obama Cuts Student Loan Costs! Can Broke Grads Be “Saved”? by Mike Larson First things first. We have instituted a new comment system that should be smoother and easier for you to use! Why Big Market Gains Are Still on the Way by Jon Markman Stocks blitzed to new highs again in the past few days, capping a remarkable three-week melt-up that’s been sparked by a growing sense that nothing can shake this market. |

THIS WEEK’S TOP STORIES

Congress Mulling Corporate Tax “Holiday”! What It Means … by Mike Larson $1.95 Trillion. Trillion with a “T”! That’s how much money American corporations are holding outside the U.S. It’s an outrageous sum, and it rose by 12 percent in the last year. Mining shares: Negative Rates Set Stage for Massive Bull Market by Larry Edelson Right after the financial crisis hit and the Federal Reserve started printing money with no end in sight, many of the media talking heads and even some very influential economists claimed that central banks were out of ammunition. Falling Real Yields: A Buy Signal for Gold by Mike Burnick Remember the good old days when you opened a savings account at your local bank and were offered a free toaster in gratitude for your business? |

{ 2 comments }

Been fallowing your facts but never signed up.

The US Government EIA has downgraded recoverable US fracking oil reserves by 66% in the last 2 weeks. So US energy independence hopes just took a big hit. The Monterey formation which constitutes about 2/3 of US fracking reserves was downgraded by 96% on the basis that the oil recovery was not economically feasible. Not good!