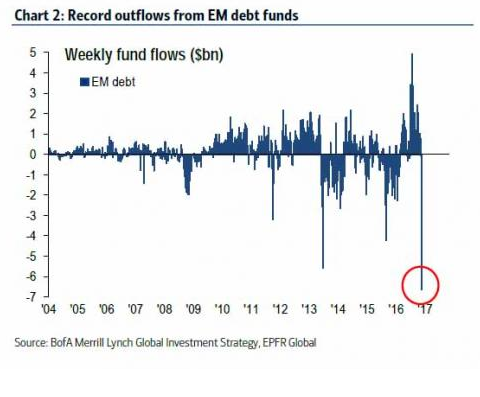

Forget Christmas in July. It’s Fourth of July near Christmas, at least judging from the market fireworks unleashed by the Trump election. Bonds have plunged the most in at least 26 years (that’s as far back as the Bloomberg Barclays Global Aggregate Index , which tracks worldwide bond prices, goes). The U.S. dollar has surged the most against the Japanese yen in 15 years, and the most against the euro since it was introduced in 1999. Meanwhile, the Chinese yuan has dropped to its lowest level since 2008. We’ve also seen a big jump in stocks, fueled by massive rotation out of bond funds and into equities. One interesting data point: Emerging market bonds experienced their worst weekly outflows in history ($6.6 billion, as shown in the chart below), while U.S. stock funds attracted $23.6 billion worth of inflows, the most in two years.

{ 3 comments… read them below or add one }

check out the TMV, mike. it’s an easy play.

For the moment, it seems like everyone knows which way to bet.

for the moment, anyway. :-))))