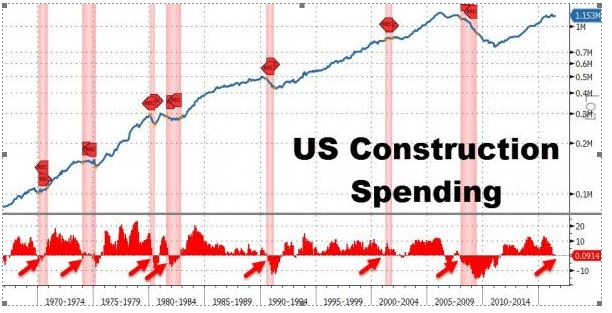

This is a very interesting chart I came across at the Zero Hedge website today. It’s similar to one I did for my All Weather Trader service recently, and it’s worth checking out.

What it shows is that construction spending is now petering out. It flatlined in the month of July on a monthly basis, compared with forecasts for a rise of 0.6%, and it’s looking lousy on a year-over-year basis, too. What’s more, construction employment, as measured by ADP and the BLS, has either flat-lined or declined for the past few months. We haven’t seen anything like that in the past half-decade.

Why does this matter? Construction was a key prop to the economy coming out of the 2007-2009 crash. But tighter lending standards in CRE, regulatory pressure on bank lending in this area, and the increased realization that we’re in a massive bubble is causing purchases, hiring, and construction to roll over. This Bloomberg story on the rapidly cooling Manhattan market is just one example of what I’m seeing.

{ 1 comment… read it below or add one }

I wonder if the Chinese buying pressure has softened?