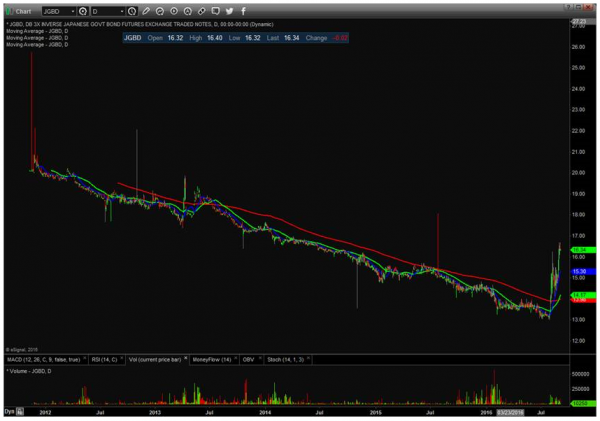

I haven’t seen it really talked about all that much. But there has been a massive sell-off in bonds … JAPANESE bonds. Check out this chart of the JGBD, a 3X inverse Japanese bond ETF. The ETF is designed to rise 3% for every 1% price decline in Japanese bonds. You can see that this ETF is having its best few weeks going all the way back to inception in late-2011 (outside of a few anomalous, intraday spikes that really don’t count). U.S. bonds have weakened in price along with JGBs, but not anywhere near as much.

What’s behind the move? Is Japan’s massive debt load and out-of-control QE program finally “blowing up” in the country’s face, much like how the Japanese yen has been disobeying the Bank of Japan and rising sharply over the past year? Is this on the assumption Japan is going to launch a massive fiscal stimulus funded by “Helicopter money,” thereby boosting the economy and driving yields up? I don’t know the answer. But this is a huge, anomalous move, so I figured I would point it out.

{ 1 comment… read it below or add one }

good job, mike. you got the eagle eye, dude! a japanese bond selloff could be good news for the nikkei, eh? it will happen here too, sooner or later too.