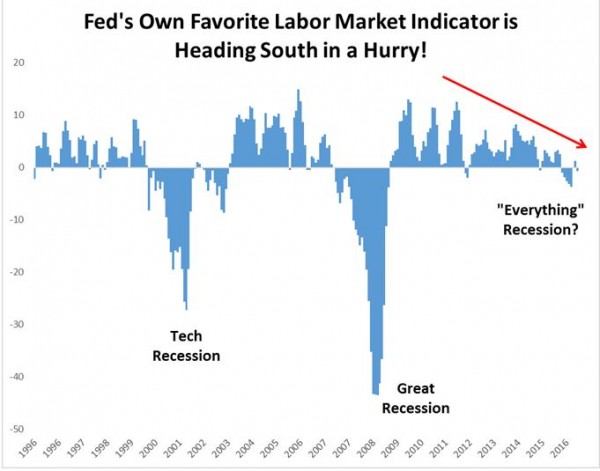

I know the stock market doesn’t seem to “care” right now. But I wanted to share this chart of the Federal Reserve’s own favorite labor market indicator. This is one Janet Yellen highlighted as capturing several labor indicators in one simple index. You can see that it has now declined in six out of the last seven months. While the decline is not (yet) anywhere near as bad as we saw during the Great Recession … or even the Tech Recession … the trend lower is harder to ignore. Indeed, we have never seen a string of consistent, persistent negative readings like this in the last two decades outside of a recession. So keep an eye on this to see if it sinks farther in the months ahead.

{ 3 comments… read them below or add one }

Yes Mike, I would like to keep an eye on this chart if I knew what it was called and where to get it. Would much appreciate being enlightened on this. Cheers.

which index is it? where can i found it?

thx

look at http://www.tradingeconomics.com/united-states/labor-market-conditions-index

called LMCI – labor market conditions index

isn’t GOOGLE wonderful, even though they own all your information

watch youtube video “Clinton Cash” to discover how truly corrupt they are – much worse than you believed