|

Tomorrow, the 45th president of the United States gets sworn in: Donald J. Trump. But a funny thing happened on the way to his inauguration ball …

The Trump Trade appears to be fizzling out, ironically, just as The Donald prepares to take the oath of office!

Look, the stock market has gone nearly parabolic since the November election, fueled by visions of generous tax cuts and plenty of fiscal-stimulus spending. Call it a Reagan redux.

So the markets are certainly overdue for at least a pause that refreshes stocks for more gains ahead. And over the past few weeks, I’ve seen numerous signs that a correction is imminent, and has perhaps already started.

If history is any guide, the road ahead for stocks could be treacherous during Trump’s first year in the Oval Office. Here are two signs that tell me it could be correction time for stocks …

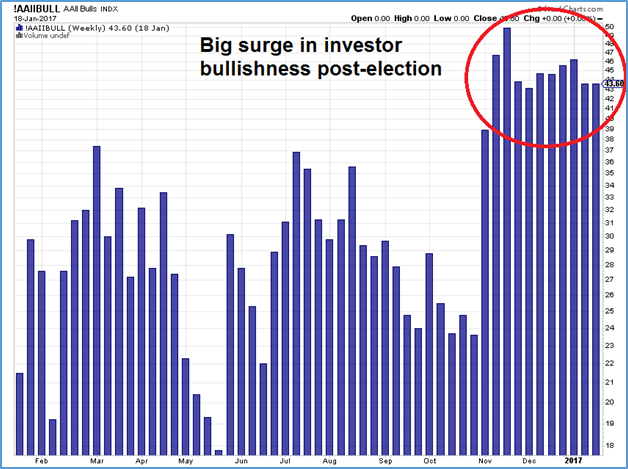

#1: Sentiment Turns Bullish … which is Bearish: Since Election Day, there has been a huge surge in bullish sentiment among individual investors, as you can see in the chart below.

The American Association of Individual Investors weekly poll of investor sentiment was consistently negative for more than a year. In fact, there wasn’t a single week where the survey responses were more than 40% bullish, dating back to October 2015.

But there’s been a dramatic change post-election, as you can see above. The week after Trump’s win, bullishness among small investors jumped to 50%, and sentiment has consistently been around 45% bullish ever since.

Of course, we read this as a contrary indicator, in that, retail investors are always late to the party, and may be piling into stocks again, just before a sharp correction!

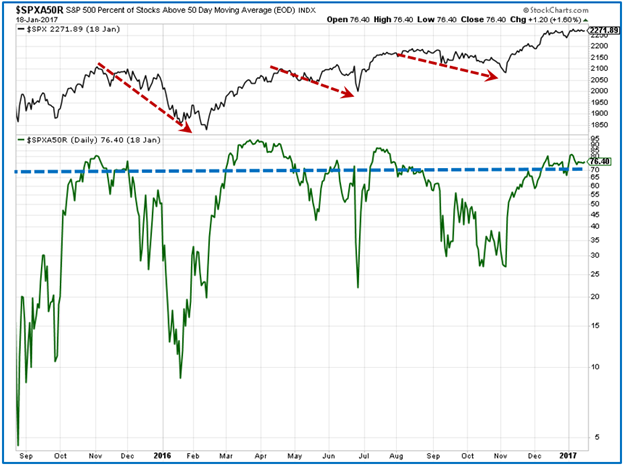

#2: Extremely Overbought: Before the election, just 30% of the stocks in the S&P 500 Index were trading above their 50-day moving average. That means 70% of stocks in the blue-chip index were in a downtrend.

Post-election and just one month later, more than 80% of stocks were trading above their 50-day moving average, as shown in the chart above.

Just as they were oversold in October, then soared, stocks are now overbought in the extreme, and overdue for a correction.

And as you can see, whenever stocks got this overbought in the recent past, a correction has soon followed.

My colleague Larry Edelson just warned that “the Dow is getting ready to roll over.” And given the warning signs above, I agree.

We both see nothing more than a correction ahead, with the first downside support at roughly 18,500 on the Dow, which means a decline of 6-7%. That shakeout should provide a good buying opportunity for stocks.

But for those who compare Trump’s presidency with the Reagan revolution of the 1980s, they should be careful what they wish for. As I pointed out previously: Stocks peaked in April 1981 – just three months into Reagan’s first term – and the Dow dropped 25% before bottoming in August 1982!

The beginning of the Trump era could bring plenty of volatility for markets.

Good investing,

Mike Burnick

Director of Research

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

Mike Burnick, with 30 years of professional investment experience, is the Executive Director for The Edelson Institute, where he is the editor of Real Wealth Report, Gold Mining Millionaire, and E-Wave Trader. Mike has been a Registered Investment Adviser and portfolio manager responsible for the day-to-day operations of a mutual fund. He also served as Director of Research for Weiss Capital Management, where he assisted with trading and asset-allocation responsibilities for a $5 million ETF portfolio.

{ 8 comments }

NEED A BETTER DISCOUNT TO BRING IN NEW MONEY

I can’t imagine adding new money to the DOW 30 Index until at least a 10% correction occurs. -5% Discount is not enough to jump-in, considering volatility (risk) is probably headed-up. You could easily see 3% daily moves at times, both up and down. Hard to hit a moving target. Only worth taking a shot if you get at least a 10% Correction first.

The day before the Presidential election CNBC assured viewers that if President Trump was elected the stock market would halve overnight.

I don’t understand.

Did NBC deliberately lie to its viewers to influence the election, or were they totally mislead by “experts”?

they lied to the american public something the major networks of CNN CNBC MSNBC NBC CBC ABC have been doing for years especially during the obama years

Yes, I would to hear the answer to that oncoming situation.

Thank you

Is this “Fake News”? I watch CNBC and NEVER heard this. Also, if a giant like CNBC had made that statement, it would be all over the internet,,,

More than likely, A Republican President and Congresss are so much more likely to destroy this rally as that has happened so much in the last 100 years…

i remember hearing them talking about a trump presidency will cut the market in half @ CNN MSNBC NBC

Thank you Mike Burnick!!! Very Good Refresher!!!! I always like to read your comments !!!!