|

The U.S. equity markets and, for that matter, most equity markets around the world, have topped.

They are now in a severe bear trend, one that will look at times like the end of the world is upon us.

You will hear all the die-hard bears come out of the woods. “Dow 5,000,” they will scream, or even lower. Another real estate crash. Plunging asset values. An emerging market crisis. Bank failures. Systemic crashes. And more.

But mark my words, the bear market that is beginning in equities is merely a temporary correction, one that will set the stage for the Dow Industrials to launch much higher, to over 31,000 in the years ahead.

I have been warning that there would be a sharp, sudden pullback in the stock markets before the real bull market begins. It’s here. It started last week. It’s going to be ugly at times. And it’s going to end later this year with almost everyone throwing in the towel, which of course, will be the time for you to back up the truck and buy big.

|

| Get ready to pounce all over stocks as soon as this temporary bear market ends. |

So that you know exactly what is going on and can be fully prepared for what’s coming, let me explain a few things:

First, stocks are not overvalued. That is not the reason the market is falling. It would be true if a dollar was worth what it was a few years ago, or 10 years ago. But the dollar is not worth what it was years ago.

That means corporate earnings can’t really be measured in nominal terms anymore. They must be adjusted for incipient inflation. And when you do that, you’ll find that corporate earnings are actually undervalued.

So much so that in nominal terms, for the Dow to catch up with the changes we have seen in the value of money over the past 12 years alone, it would have to rally to a minimum of 26,570.

Second, rising interest rates are not the problem either. I’ve explained this before, and I’ll mention it again: Stocks are not falling because interest rates are rising or because the Federal Reserve is tapering its bond purchases and starting to take away the punch bowl, so to speak.

That’s hogwash. Throughout history, most major bull markets in equities — and commodities, for that matter — occur when interest rates are rising.

The reason for that is simple: If the cost of money and credit is rising, then typically the economy is growing. And if the economy is growing, so is consumer demand, industrial production and so forth.

There are other reasons interest rates rise, of course, like rising inflation. But that too is bullish for equities, not bearish.

There are only two situations where interest rates are bearish for equities and none of them apply to the equity markets at this time. One is if interest rates rise to well above the current rate of inflation, such as when Volcker pushed rates to 20 percent in 1980.

The other is when there is a systemic failure of some sort and there is no money or credit to be had, at any price.

We’re not at those points yet, not by a long shot. We will get to them some day, but not for many years to come.

Third, technically and cyclically, a pullback is perfectly normal and must occur before the markets can head any higher.

Whenever a market moves up into new territory, to uncharted waters, there is inevitably a pullback to test the former pressure points, or the origin of the move.

As you can see from this long-term monthly chart of the Dow Industrials, the breakout has been significant.

Moreover, a move back to the points of origin of the breakout is perfectly normal. Those support levels on the monthly chart lie at 15,180, 14,000 and 13,400.

Those are simply technical chart support levels. The real support for the Dow will come into play at my system reversal levels, which are 14,687.05 … 14,373.32 … and 14,030.37.

Bottom line: I expect the Dow to fall to the 14,000 to 14,373 level during this temporary bear market.

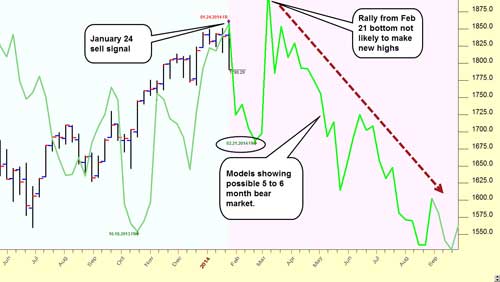

How long will this bear market last? That’s a key question for sure. For that, we turn to timing models. Here is the latest cycle chart for the Dow.

Notice first, the sell signal it generated on Jan. 24. That was day one of the breakdown.

Also note the following:

Â Cycles show a decline into Feb. 21, followed by …

Cycles show a decline into Feb. 21, followed by …

Â A bounce into the early part of March.

A bounce into the early part of March.

Importantly, I do not expect new highs in the broad indices, as this timing chart might imply. There are many reasons for that, too varied and complex to cover in this column.

Â But then notice the wicked decline this cycle chart shows, the potential for the Dow to move lower all the way into August before bottoming.

But then notice the wicked decline this cycle chart shows, the potential for the Dow to move lower all the way into August before bottoming.

This is why I say you’re going to hear a lot of doomsayers come out of the woodwork. The temporary bear market equities are entering is going to be volatile and it’s going to last for up to six or seven months. It will not be pretty.

My best advice is to clear out of nearly all equity investments now, preserve your firing power, but be ready to pounce all over stocks as soon as this temporary bear market ends. For when it ends, the Dow’s next big move will be to vault to 21,000 … then 25,000 … and then even higher.

Speculative investors should consider inverse ETFs for the Dow and S&P 500 for some upcoming ripe profit opportunities on the downside.

Best wishes,

Larry

{ 3 comments }

If the pullback unfolds as you expect, do you think safe-haven buying of gold will drive gold and miners higher? Thanks.

You say it's time to buy property, but should I not wait for the bottom in this market first.

If Real Estate is so bad why is the ETF REK going down for awhile now down 35% from the pick way back